Traditional Venture Debt

Since the 1970s, venture debt has been a significant source of capital for early-stage startups with the necessary assets to flourish. When traditional bank financing was out of reach, venture leasing bridged the gap and secured equipment financing against specific assets. As reputable venture capital firms emerged in the 1980s and 1990s, lenders like Silicon Valley Bank followed the lead of influential firms (and key VC partners at those firms) and extended loans to startups in exchange for warrants, deposit relationships, and other fee-generating financial services.

With the collapse of Silicon Valley Bank, the landscape of venture lending is undergoing a massive structural shift, leading to a new chapter in financing. Traditional banks can no longer spread lending risk on a portfolio of services approach. Entrepreneurs need partners that understand their business and the risk associated with growth. As the Venture Debt industry pulls back, a new approach is warranted.

Modern Venture Debt

Wheelhouse is disrupting venture lending with a new and innovative focused approach. Just as the venture capital industry grew over the last 20 years, more and more firms emerged with industry vertical expertise bringing more insights into investing and more value to their portfolio. The Venture Debt industry is also going through this transition. Having a vertical industry approach benefits from better insights into lending risk and finally adding value to entrepreneurs beyond writing a check.

Wheelhouse Approach

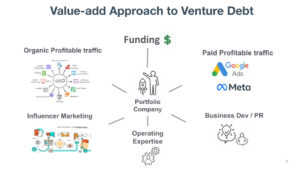

At Wheelhouse we couple 40-plus years of lending experience with deep operating and online digital marketing know-how. As operators and CEOs of online direct B2B and B2C businesses, we understand what is going on with your business under the hood. This means we can better assess product market fit, credit risk, and growth levers.

With a focused approach, we better understand your business beyond traditional financial models. We will spend as much time with your online dashboards (Google, Meta, Shopify, SEO rankings, and more) as we do with traditional financial metrics.

More importantly, we can roll up our sleeves and help you accelerate profitable growth.

![]()